How is your house assessed for residential aged care?

For many people moving into aged care, their home is likely to be the biggest remaining asset. If you move into aged care, unless a spouse or other family member continues to live in your home you may be faced with a major decision of whether to sell or keep your home.

This is an important decision that needs to be made with consideration to the impact on:

- Age pension entitlements

- Aged care fees

- Capital gains tax

- Inheritance plans

- The cost of renovations and/or maintenance

- Your personal preferences.

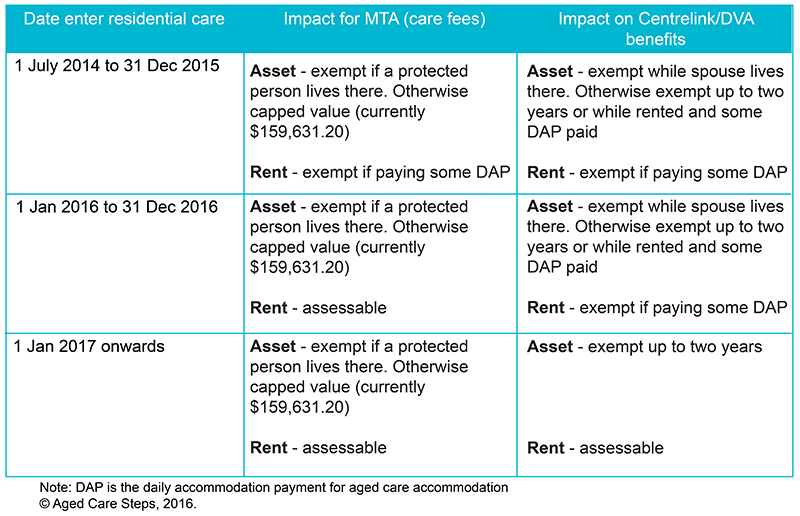

The government previously provided concessions on the assessment of the home for both assets and income testing but these concessions have been gradually removed, with further changes impacting age pension entitlements from 1 January 2017.

If you keep your former home, how it is assessed will depend on which year you moved into permanent residential care and whether you are looking at the impact on fees or Centrelink/Veterans’ Affairs (DVA) benefits. This is summarised in the table below.

Example 1:

Alice moves into residential aged care in October 2016. Her husband Archie continues to live in their home. The home is an exempt asset when calculating aged care fees (using the means-tested amount – MTA). For age pension purposes Alice and Archie continue to be assessed as homeowners and the home is an exempt asset.

Example 2:

Myra is single and lived alone before she moved into residential aged care in October 2016. She agreed to pay an accommodation payment of $350,000 and chose to pay $300,000 as a refundable accommodation deposit (RAD). The remaining $50,000 was converted into a daily accommodation payment – DAP. She rented out her former home.

For age pension purposes Myra remains a homeowner and her home is an exempt asset. This will change if she no longer rents her home or she pays the rest of the accommodation payment as a RAD or she sells the home. Her rental income is not assessed.

When calculating her aged care fees and the level of government subsidies, her home is assessed at the capped value of $159,631.20 and the rental income (after allowable deductions) is assessable.

Example 3:

If Myra moves into care in February 2017, for age pension purposes she will only remain a homeowner for up to two years (or until home is sold) and the rental income (less allowable deductions) is assessable income.

When calculating her aged care fees and the level of government subsidies, her home is assessed at the capped value of $159,631.20 and the rental income (after allowable deductions) is assessable.